Commercial Loan Portfolio Insights In Real Time

Qualtik provides better visibility into the risk profile of your commercial loan portfolio and the ability to better analyze scenarios in a quickly changing economic environment. With our unique loan portfolio analysis software, you can proactively manage your concentrations, monitor your capital ratios, stress test appropriate segments of your portfolio and generate custom reports, minus the guesswork or hassle.

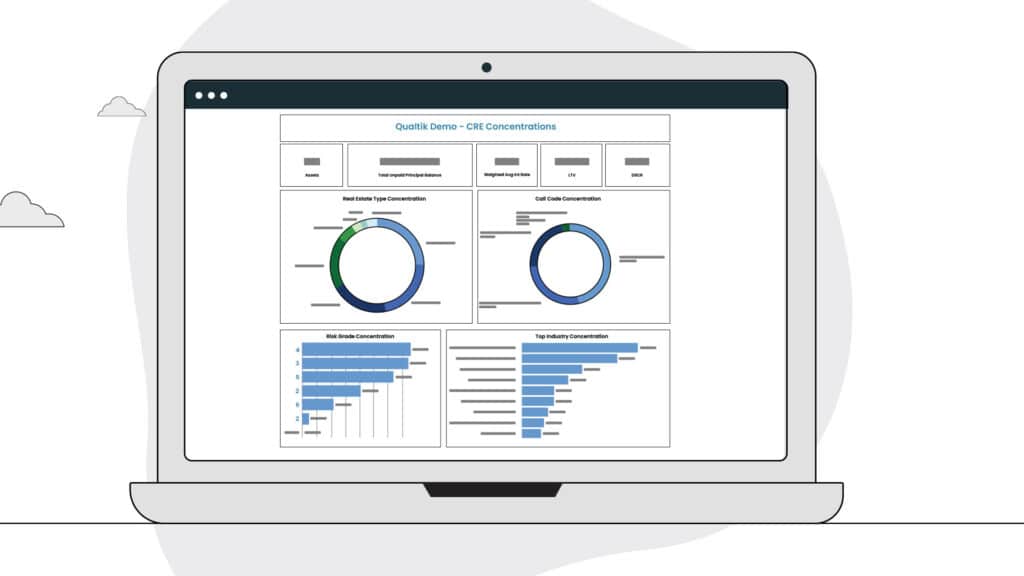

Dynamic CRE and C&I Portfolio Analysis

Qualtik’s loan portfolio analysis software provides a configurable view of key metrics at both the portfolio and asset level with interactive dashboards.

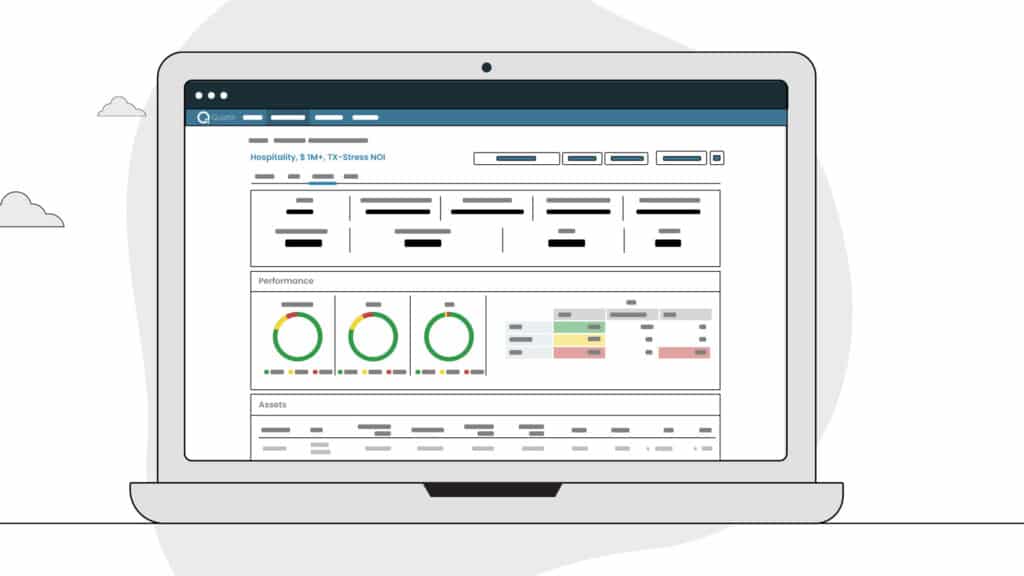

Fast, Flexible Stress Testing

To effectively manage commercial loan portfolio risk, banks need bottom-up stress testing tools that provide the flexibility to evaluate the impact of ever-changing market dynamics. Stress testing from Qualtik is fast and flexible.

Board Report Automation

Save hours of manual work and deliver clear, data-driven insights to your board with Qualtik’s automated reporting tools:

Why spend 80% of your time gathering and organizing your data and only 20% analyzing it? With Qualtik, you can flip that.

A Few of the Banks Benefiting from Qualtik

About The Team

We’re a team of developers, salespeople, and customer service professionals with a long track record of working with banks. Qualtik brings superior commercial loan portfolio analysis and reporting software to commercial lenders.

News

Stress Testing and Scenario Planning for Community Bank Portfolios in 2026

Approaching stress testing with this perspective adds a valuable strategic tool to your portfolio analysis tool belt, giving leadership actionable insight during a pivotal planning period.

Modernizing M&A Due Diligence and Integration: How Community Banks Use Qualtik to Navigate Mergers with Clarity and Confidence

Qualtik gives community banks the ability to examine loan portfolios interactively at every stage of the M&A process. Whether evaluating a potential partner or preparing for post-merger reporting, credit teams gain instant visibility into portfolio health and can make faster, better-informed decisions.

Eliminating Static Reporting: Banks Streamline Commercial Loan Portfolio Analysis and Decision-Making with Qualtik

By eliminating inefficiencies and enhancing data interaction, Qualtik empowers banks to make confident, data-driven decisions—without the delays of traditional reporting methods.