Fast and Flexible Analysis

and Reporting for Commercial Loan Portfolios

It’s not a pipe dream. It’s Qualtik.

Experience the Difference with Qualtik

Qualtik’s powerful filtering lets you dive right into analyzing your commercial loan portfolio or a single loan, uncovering insights, proactively identifying risk, and making more strategic decisions. Generate dynamic, interactive reports for board members, management, or regulatory purposes in minutes instead of days. Answer tough questions from board members or auditors without breaking a sweat.

Understand your commercial loan portfolio risk profile.

Filter and stress for your commercial loan portfolio.

Drill in using dynamic dashboards and generate reports.

Answers — for board members and regulators — fast.

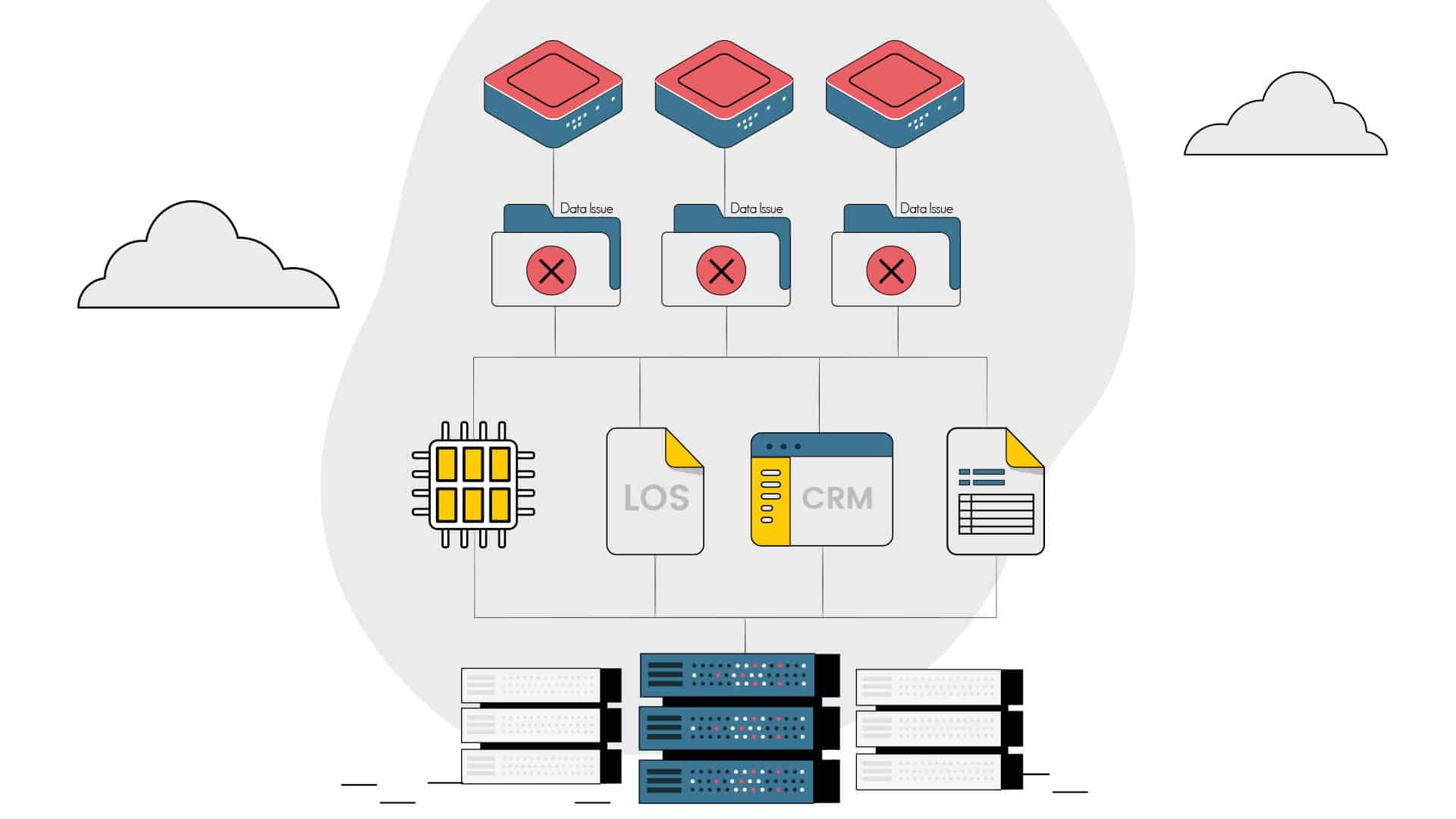

How do you get my data into Qualtik?

Qualtik is designed to be an easy step from your current systems and processes, and to add value immediately. There are no integrations needed. Data is imported using the same methodology lenders already use to pull data from their core system into spreadsheets. Once data is imported, banks use Qualtik to hone in on the concentrations that are most important to them and identify and address gaps and errors in the data as they analyze and report on their commercial loan portfolio. Our customers save days per month on analysis time and report generation.

Qualtik Platform Features and Benefits

Interactive Dashboards

Qualtik dashboards and reports are interactive. Drill into the detail behind a specific concentration. Set as many filters as you desire to focus on specific segments of your portfolio.

Flexible Stress

Testing

As the market shifts and regulators or your board ask new questions, generate concentration specific stress scenarios, with your specific performance criteria, in minutes.

Board Report Automation

Save hours of manual work and deliver clear, data-driven insights to your board with Qualtik’s automated reporting tools

Generate

Reports

Generate professional, consistent and consumable reports for your board members and regulators, quickly.

Data Security

Qualtik is committed to the security of customer data. Our leadership team has a background in building highly secure financial systems that support some of the world’s largest brands and financial institutions. We continually invest in our systems and security program to ensure we adhere to security best practices and exceed regulatory requirements. Here are some of the ways we keep your data safe:

GET MORE BRAIN POWER OUT OF YOUR BEST ANALYTICAL MINDS

Why spend 80% of your time gathering and organizing your data and only 20% analyzing it? With Qualtik, you can flip that.

Wanna flip your equation?