Commercial Loan Portfolio Stress Testing

CRE Stress Testing Built for Banks

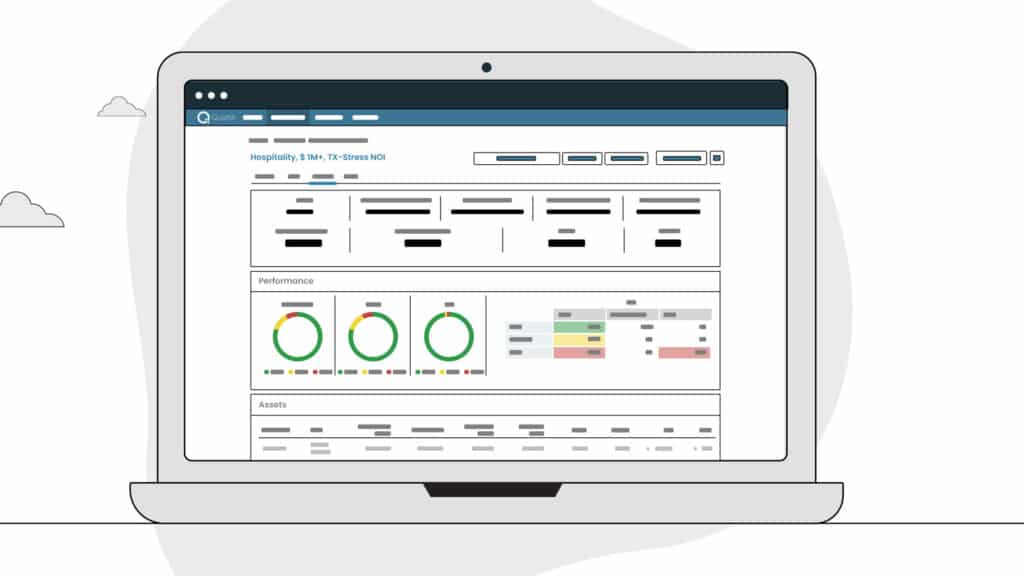

As the risk landscape changes, lenders frequently find themselves needing to run a range of stress scenarios in order to analyze potential impact on specific segments of their loan portfolio. With Qualtik, filter down to any concentration you wish, set your performance thresholds, and apply the stress that fits the current environment.

Run Detailed Stress Scenarios in Minutes

Many banks use spreadsheets to apply stress on individual loans during underwriting and loan review. There is a better way. Not only are things faster and less error prone with Qualtik, but the platform also expands your options for additional analysis, such as applying stress to watch lists and specific concentrations in an efficient and scalable way:

Collateral Stress Testing for Commercial Loans

The OCC recommends stressing collateral values on commercial loans. Does it make sense to apply an even stress across all concentrations? Our customers typically say this doesn’t go far enough to identify risk.

Apply filters to focus on specific concentrations, apply the LTV parameters and stress criteria quickly, and generate professional reports.

Jeff Wilkinson, Chairman & CEO, Keystone Bank

BUILT FOR BANKS